Did you know comparing insurance quotes can save you hundreds of dollars a year? With so many options, finding the right coverage at a good price can be tough. But, knowing how to navigate this can save you a lot.

To get a low insurance premium, compare quotes from different providers. This article will show you how to do this. It will also tell you what to look for when picking an insurance quote.

Key Takeaways

- Comparing multiple insurance quotes can lead to significant savings.

- Understanding the factors that affect your insurance premium is key.

- Good comparison looks at more than price; it’s about coverage and service too.

- Shopping at the right time can change your insurance quote.

- Knowing what affects your rates helps you make smarter choices.

Understanding Insurance Premiums

It’s important to know what affects your insurance premium. Premiums are the costs for keeping your insurance active. They can change a lot based on different factors.

What Determines Your Insurance Premium

Several key elements influence your insurance premium. These include personal risk factors, coverage levels, and deductibles.

Personal Risk Factors

Things like age, health, and lifestyle choices affect your premium. For example, smokers or people with health issues might pay more. This is because they are seen as higher risk.

Coverage Levels and Deductibles

The amount of coverage you want and your deductible also matter. More coverage and lower deductibles mean higher premiums. This is because the insurer takes on more risk.

How Insurance Companies Calculate Rates

Insurance companies use complex methods to figure out rates. They look at personal risk, coverage, and deductibles. They also use data and actuarial tables to understand risk and set premiums.

Knowing these factors helps you choose the right insurance. This way, you can meet your needs while keeping costs down.

Key Factors That Affect Your Insurance Premium

Insurance premiums are not random; they’re based on many factors. These factors help insurers understand the risk and other important details. Knowing these can help you choose the right insurance policy.

Risk Assessment Variables

Insurers look at several things to figure out the chance of a claim. For auto insurance premium, they check your driving history, the type of vehicle, and how much you drive each year. For health insurance premium, they look at your medical history, age, and lifestyle.

Demographic and Geographic Considerations

Where you live and who you are also matter a lot. For auto insurance premium, living in a high-crime area or busy city can raise your rates. For health insurance premium, the cost of healthcare in your area can also affect your rates.

Credit-Based Insurance Scoring

Credit scores are another key factor for insurers. People with better credit scores are seen as more reliable. This can lead to lower insurance premiums for them.

| Factor | Auto Insurance Impact | Health Insurance Impact |

| Credit Score | Higher score = lower premium | Higher score = lower premium |

| Age | Younger drivers = higher premium | Older age = higher premium |

| Location | Urban areas = higher premium | Local healthcare costs affect premium |

Preparing to Shop for Insurance Quotes

Before you start looking for insurance quotes, get ready with the right info. This will make the process smoother and help you find the best insurance quote.

Essential Information to Gather

To get a precise insurance quote, you’ll need certain details. This includes:

Personal Documentation

- Identification documents

- Financial records

Asset Information

- Details about the assets you want to insure, such as your home

- Any relevant history, like previous claims on your homeowners insurance premium

Determining Your Coverage Needs

Understanding what you need to cover is key. Think about what you want to protect and the risks involved. For homeowners, knowing how much it would cost to rebuild your home is important. This affects your homeowners insurance premium.

Setting a Realistic Budget

It’s important to set a budget for your insurance. Look at different quotes and weigh the costs against the coverage. This way, you can find the best insurance quote for your budget.

| Coverage Aspect | Considerations |

| Personal Documentation | ID, Financial Records |

| Asset Information | Asset Details, Claims History |

“The key to finding the right insurance is not just about the price; it’s about understanding your needs and finding a policy that matches those needs.”

Insurance Expert

Step-by-Step Guide to Comparing Insurance Quotes

Finding the right insurance policy starts with comparing quotes. It’s important to have a clear plan to make a smart choice.

Creating a Standardized Comparison Framework

To compare insurance quotes well, you need a clear framework. List the main parts of each policy, like coverage limits, deductibles, and what’s not covered. This way, you can easily see the car insurance premium and life insurance premium from different companies.

Here’s an example of a comparison table:

| Insurance Provider | Coverage Limit | Deductible | Premium |

| Provider A | $100,000 | $500 | $800 |

| Provider B | $150,000 | $1000 | $1200 |

| Provider C | $200,000 | $2000 | $1800 |

Evaluating Coverage Details Beyond Price

Price is important, but it’s not everything. Look at what’s covered, policy terms, and extra benefits. For example, some life insurance policies have special riders or benefits that others don’t.

Tracking and Organizing Multiple Quotes

Handling many insurance quotes at once can be tough. Use a spreadsheet or a tool to keep track of them. Note the provider, policy details, and cost. This makes it easier to compare and find the best deal.

By following these steps, you can compare insurance quotes effectively. This way, you can choose a policy that fits your needs and budget.

Finding Auto Insurance Premium Quotes

Finding affordable auto insurance quotes means knowing what affects your cost. It’s also about using the right resources. With many options, finding the best quotes requires a smart approach.

Online Comparison Tools for Car Insurance

Online tools have changed how we look for auto insurance. They let you compare quotes from different providers easily. Just enter your details once to get quotes from many insurers, saving you time.

Working with Auto Insurance Agents

Online tools are handy, but agents offer personalized advice. They help you understand policy details, ensuring you make the right choice. Their knowledge is key in dealing with insurance terms and finding the best options.

Discounts That Lower Your Car Insurance Premium

Insurance companies have discounts that can cut your premium. Knowing about these can save you money.

Safe Driver Discounts

Safe driver discounts are for those with clean driving records. Avoiding accidents and tickets can lower your premiums.

Vehicle Safety Feature Savings

Cars with safety features like lane warning systems get vehicle safety feature savings. These features reduce accident risks, making your car cheaper to insure.

Using online tools, agent advice, and discounts can help lower your insurance premium. This way, you can find the best quotes out there.

Navigating Health Insurance Premium Options

Understanding health insurance premiums can be tough. But knowing your options is key. Premiums are a big cost for many, and smart choices can help manage these costs.

Marketplace vs. Employer-Sponsored Plans

Choosing between a marketplace plan and an employer-sponsored plan is a big decision. Marketplace plans are bought through the health insurance marketplace. They might offer subsidies based on income. On the other hand, employer-sponsored plans are part of your job benefits.

When comparing, think about premium costs, coverage, and what you’ll pay out-of-pocket. Employer plans might offer better coverage and lower premiums because of employer help.

Understanding Subsidies and Tax Credits

Subsidies and tax credits can lower health insurance costs for some. Premium tax credits help with monthly costs for those buying through the marketplace.

To get these credits, you must meet income rules and not have other coverage like Medicaid or certain employer plans.

Comparing Health Insurance Deductibles and Premiums

Choosing a plan means balancing deductibles and premiums. Plans with lower premiums often have higher deductibles. This means you pay more before insurance helps.

High-Deductible vs. Low-Deductible Plans

High-deductible plans have lower premiums but higher deductibles. They’re good for the healthy who don’t expect big medical bills. Low-deductible plans cost more but have lower deductibles. They offer more coverage right away.

HSA and FSA Considerations

High-deductible plan holders might find HSAs useful. They let you save pre-tax for medical costs. FSAs can also help with some expenses, depending on your plan.

| Plan Type | Premiums | Deductibles | HSA/FSA Eligibility |

| High-Deductible | Lower | Higher | Yes (HSA) |

| Low-Deductible | Higher | Lower | Yes (FSA) |

By looking at these factors, you can make choices that fit your needs and budget.

Securing Affordable Homeowners Insurance Premiums

To get affordable homeowners insurance, it’s key to know how insurers figure out premiums. Premiums can change a lot based on your home, where it’s located, and your financial status.

Home Features That Affect Insurance Costs

Your home’s features greatly affect your insurance cost. The age of your home, its construction, and safety features like storm shutters matter. For example, homes with fire-resistant materials or recent renovations might get lower rates.

Bundling Opportunities for Savings

Combining your homeowners insurance with auto insurance can save you money. Insurers give multi-policy discounts for buying more than one policy. This can lower the cost of both policies.

How to Lower Your Homeowners Insurance Premium

There are ways to cut your insurance premium. Making your home safer and more disaster-resistant can help.

Home Security Improvements

Boosting your home’s security can lead to cheaper insurance. Adding security systems, reinforced doors, and smart locks makes your home less risky. This might earn you discounts.

Weather Mitigation Discounts

Insurers offer discounts for homes that protect against weather risks. Installing storm shutters, impact-resistant windows, or reinforcing your roof can save you money. These steps also protect your home.

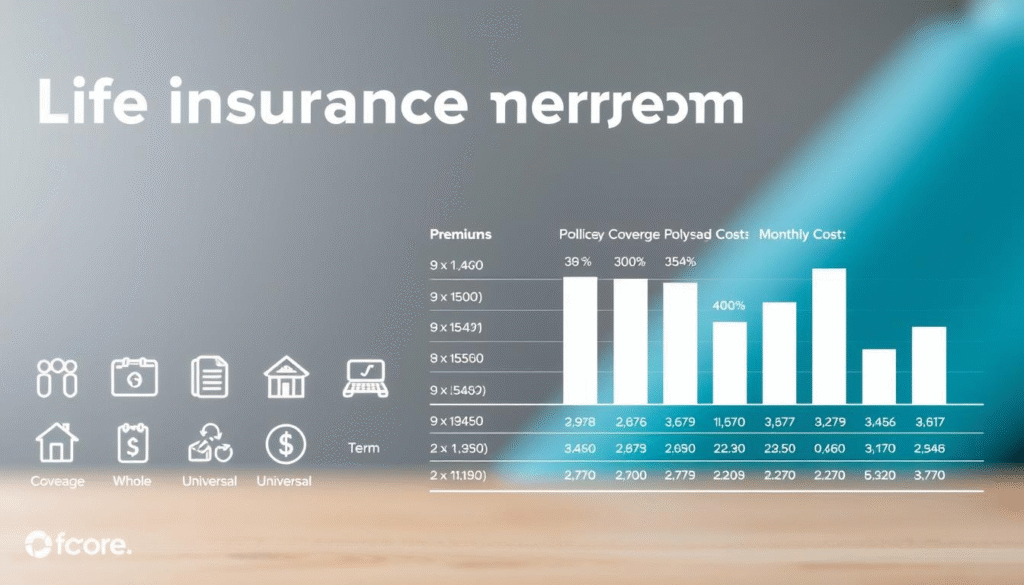

Life Insurance Premium Comparison Strategies

Comparing life insurance premiums is key to getting the right coverage at a good price. There are many insurance providers with different policies. Knowing the differences helps you make a smart choice.

Term vs. Whole Life Insurance Costs

When looking at life insurance costs, you have to decide between term and whole life. Term life insurance covers you for a set time, like 10 to 30 years, and is cheaper. Whole life insurance covers you forever and has a cash value, making it pricier.

Term Life Insurance is good for those needing coverage for a certain time, like until kids are grown. Whole Life Insurance offers a guaranteed death benefit and a growing cash value. This cash value can be used for loans or to pay premiums.

| Insurance Type | Coverage Period | Premium Cost | Cash Value |

| Term Life | Specified term (e.g., 10-30 years) | Generally lower | No cash value |

| Whole Life | Lifetime | Generally higher | Cash value accumulates |

Age and Health Factors in Life Insurance Pricing

Age and health are big factors in life insurance pricing. The younger and healthier you are, the lower your premiums will be.

“The cost of life insurance is directly related to your age and health status. Insurers view younger applicants as less risky, resulting in lower premiums.” –

Insurance Industry Expert

Finding the Best Value in Life Insurance

To find the best value, compare quotes from different insurers. Look at both the premium cost and the coverage.

Medical Exam vs. No-Exam Policies

Some life insurance policies need a medical exam, while others don’t. Policies without a medical exam are easier but might cost more or have lower coverage limits.

Rider Options and Their Costs

Riders add extra features to your policy, like accidental death benefit or long-term care. Each rider increases the cost. It’s important to consider if the benefits are worth the extra money.

Understanding what affects life insurance premiums and comparing policies helps you get the coverage you need at a price you can afford.

Using Insurance Comparison Websites Effectively

Finding affordable insurance premiums starts with using comparison websites well. There are many sites out there. It’s key to know how to use them to get the best insurance quotes.

Top Platforms for Comparing Multiple Quotes

Many trusted websites help compare insurance quotes from different providers. Some of the best include:

- Policygenius

- Bankrate

- NerdWallet

- Insure.com

These sites let you see quotes from various companies. This makes it simpler to find the best rates.

How to Input Information for Accurate Results

To get precise results, it’s important to fill out your info correctly. This means:

- Entering accurate personal and demographic details

- Specifying the correct coverage needs

- Providing the right vehicle or property details (if needed)

What to Watch Out for When Using Comparison Sites

Even though comparison sites are helpful, there are things to watch out for:

- Some sites might not show quotes from all providers

- Be careful of sites that ask for too much personal info

- Remember, quotes might not always be the final premium

Knowing these points and using comparison sites wisely helps you compare insurance quotes well. This way, you can find the best insurance premiums.

Working with Independent Insurance Agents

Working with an independent insurance agent has many benefits. They offer access to many insurance products and give personalized advice. These agents work with several insurance companies. This means they can find the best options for your needs.

Benefits of Using an Independent Agent

One big plus of using an independent agent is their ability to compare policies. This helps you make smart choices about your insurance premium. They also offer expert advice. This helps you understand complex insurance terms and rules.

Questions to Ask Your Insurance Agent

To get the most from an independent agent, ask the right questions. Find out about their experience with policies like yours. Ask how they can help you find the best insurance quote. Knowing how they compare policies and their recommendations is also key.

How to Evaluate Agent Recommendations

When looking at an agent’s suggestions, check the coverage, policy limits, and cost of the insurance premium. It’s also important to look at the insurance company’s reputation. And make sure they offer good customer service.

Proven Strategies to Lower Your Insurance Premium

Understanding what affects your insurance rates can help you save a lot. To lower your premium, make smart choices and plan well.

Improving Your Credit Score for Better Rates

Insurance companies look at your credit score to set your rates. Improving your credit score can get you better rates. Pay bills on time, cut down debt, and check your credit report to boost your score.

Adjusting Deductibles and Coverage Limits

Changing your deductibles and coverage can change your premium a lot. Higher deductibles mean lower premiums, but make sure you can pay the deductible if needed.

Loyalty Discounts and Multi-Policy Savings

Many insurers give loyalty discounts to long-term customers. Also, getting multiple policies from the same company can save a lot of money.

Annual Policy Review Process

It’s important to review your insurance policy every year. An annual review lets you adjust coverage to fit your current needs, which can lower your premium.

Using these strategies can help you lower your insurance premium and save money.

Conclusion

Getting the best insurance premium means being well-informed and proactive. We’ve looked at what affects insurance costs and how to compare and lower them.

Knowing how insurance companies calculate rates and improving your risk profile can help lower your premiums. Here’s a quick summary of the strategies we discussed:

| Strategy | Potential Savings |

| Improving Credit Score | Up to 30% |

| Bundling Policies | Up to 20% |

| Adjusting Deductibles | Variable |

By using these strategies and staying informed, you can save a lot on your insurance premium. This ensures you’re financially secure and at peace.

Sources

For more details on insurance quotes and how to compare them, check out these resources:

- Consumer Reports: Homeowners Insurance

- NerdWallet: Health Insurance Guide

- Bankrate: Auto Insurance

- Policygenius: Life Insurance

These sites offer detailed guides and tools. They help you understand insurance better. This way, you can make smart choices about your coverage.

FAQ

What factors determine my insurance premium?

Many things affect your insurance premium. This includes your personal risk, how much coverage you have, and your deductible. Your location and credit score also play a role.

How do insurance companies calculate rates?

Insurance companies use special formulas to figure out your rates. They look at your risk, claims history, and other data. This helps them set your premium.

What is credit-based insurance scoring?

Credit-based scoring is how insurers judge your creditworthiness. They use it to guess if you might file a claim. This affects your premium.

How can I lower my auto insurance premium?

To lower your auto insurance, look for discounts. Safe driving and bundling policies can help. Adding safety features to your car also reduces costs.

What is the difference between term and whole life insurance?

Term life insurance covers you for a set time. Whole life insurance lasts your whole life and also builds cash value.

How can I compare health insurance premium options?

To compare health insurance, look at plans from the marketplace and your employer. Consider subsidies and tax credits. Also, compare deductibles and premiums.

What home features affect insurance costs?

Certain home features impact insurance costs. The age and condition of your home matter. So do safety features and location, like flood zones or high-crime areas.

How can I lower my homeowners insurance premium?

To lower your homeowners insurance, bundle policies. Improve your home’s security. Also, make upgrades to protect against weather damage.

What are the benefits of working with an independent insurance agent?

Independent agents offer personalized service. They help you compare quotes and advise on coverage. This can save you money.

How can I improve my credit score to get better insurance rates?

Improve your credit by paying bills on time and reducing debt. Check your credit report for errors. This can lower your insurance rates.

What is the importance of an annual policy review?

Reviewing your policy annually is key. It ensures your coverage is current. You can adjust deductibles and coverage. Plus, find new discounts and savings.